When it comes to managing your finances, understanding what liabilities are is crucial. These financial obligations can significantly impact your overall financial health and decision-making. Whether you’re an individual or a business owner, recognizing how liabilities work can help you make informed choices that lead to greater stability.

What Are Liabilities?

Liabilities represent financial obligations that you owe to others, which can impact your financial health. Understanding various types of liabilities enables better financial management.

Short-term liabilities include debts due within a year. Common examples are:

- Accounts payable: Money owed for goods or services received.

- Credit card debt: Outstanding balances on credit cards.

- Loans: Short-term personal loans needing repayment soon.

Long-term liabilities extend beyond one year, typically involving larger sums. Examples consist of:

- Mortgages: Loans secured by real estate property.

- Bonds payable: Debt securities issued to investors with scheduled repayments.

- Student loans: Financial aid borrowed for education that requires repayment over time.

You might also encounter contingent liabilities, which depend on future events. These include:

- Lawsuits: Potential legal claims against you that could result in payouts.

- Product warranties: Obligations based on guarantees made to customers regarding product performance.

Recognizing these categories helps you assess your total debt load and formulate effective strategies for managing finances more efficiently.

Types of Liabilities

Liabilities fall into several categories that help you understand your financial obligations. Recognizing these types aids in effective financial planning.

Current Liabilities

Current liabilities are short-term financial obligations due within one year. You encounter these regularly, and they can significantly impact cash flow. Examples include:

- Accounts payable: Money owed to suppliers for goods or services received.

- Credit card debt: Outstanding balances on credit cards that require payment.

- Short-term loans: Loans with a repayment period of less than one year.

Managing current liabilities effectively ensures liquidity and operational stability.

Long-Term Liabilities

Long-term liabilities refer to debts payable over a period exceeding one year. These obligations often involve larger sums and long-term commitments. Common examples consist of:

- Mortgages: Loans secured by real estate, typically repaid over 15 to 30 years.

- Bonds payable: Debt securities issued to investors with interest payments scheduled over time.

- Student loans: Borrowed funds for educational expenses, usually requiring repayment after graduation.

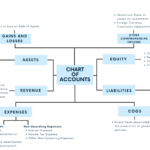

Understanding Liabilities in Financial Statements

Liabilities play a crucial role in financial statements, affecting your financial analysis and decision-making. Recognizing how they are represented can enhance your understanding of overall financial health.

Balance Sheet Representation

On the balance sheet, liabilities appear alongside assets and equity. They provide insight into what you owe versus what you own. Current liabilities show obligations due within one year, such as:

- Accounts payable

- Short-term loans

- Credit card debt

Long-term liabilities indicate debts payable over more than one year, including:

- Mortgages

- Bonds payable

- Student loans

This layout helps assess liquidity and solvency.

Impact on Financial Ratios

Liabilities significantly influence various financial ratios that gauge performance. For instance, the debt-to-equity ratio compares total liabilities to shareholders’ equity, revealing leverage levels. High ratios may indicate risk but also potential for growth.

The current ratio, calculated by dividing current assets by current liabilities, assesses short-term financial health. A ratio above 1 shows good liquidity.

Understanding these metrics enables better evaluation of your fiscal status and aids in making informed decisions about future investments or spending strategies.

Importance of Managing Liabilities

Managing liabilities effectively is crucial for maintaining financial stability. Proper management helps individuals and businesses avoid excessive debt accumulation. By keeping track of your obligations, you can ensure timely payments and protect your credit score.

Effective liquidity is essential. Meeting short-term liabilities on time prevents cash flow issues. For example, if you fail to pay suppliers or service providers promptly, it can disrupt operations and harm relationships.

Long-term liabilities require strategic planning. You must assess your ability to meet mortgage or loan payments over time. This assessment involves understanding interest rates and repayment terms, which directly affect overall financial health.

Monitoring ratios related to liabilities aids in decision-making. The debt-to-equity ratio indicates how much debt you use in relation to equity. A high ratio might signal risk, prompting a review of spending habits or investment strategies.

Contingent liabilities also deserve attention. You should evaluate potential future obligations from lawsuits or warranties. Understanding these risks prepares you for unexpected costs that could impact finances significantly.

Ultimately, managing liabilities leads to informed decisions about investments and spending strategies. A comprehensive approach ensures that you’re not just reactive but proactive about your financial future.