Have you ever wondered what keeps a business running smoothly behind the scenes? Operating liabilities are crucial components of a company’s financial health, representing obligations that arise from day-to-day operations. Understanding these liabilities is essential for anyone looking to grasp how businesses manage their cash flow and maintain operational efficiency.

Understanding Operating Liabilities

Operating liabilities represent the financial obligations that a business incurs during its daily operations. These liabilities play a crucial role in assessing cash flow and overall operational efficiency.

Definition of Operating Liabilities

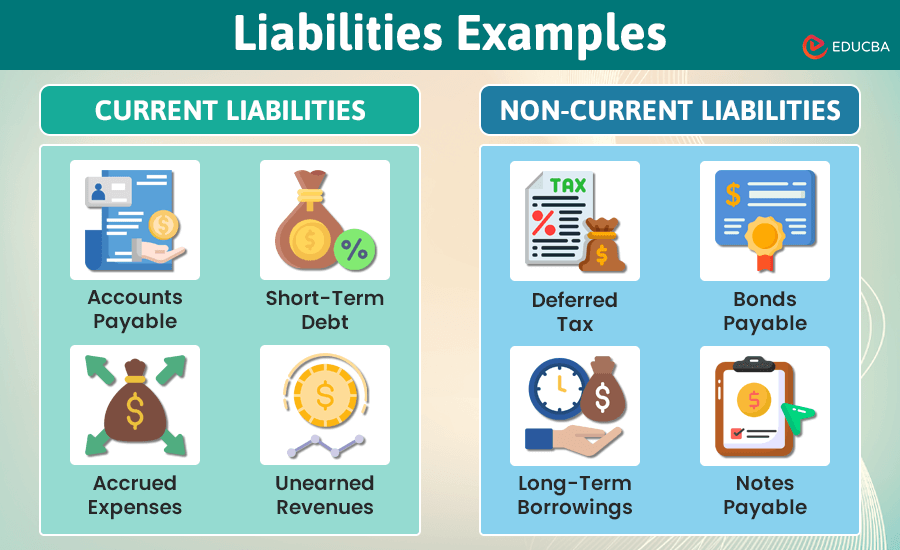

Operating liabilities include short-term obligations that arise from regular business activities. They typically consist of:

- Accounts payable: Money owed to suppliers for goods or services received.

- Accrued expenses: Expenses incurred but not yet paid, like wages or taxes.

- Short-term loans: Borrowings that need repayment within one year.

Understanding these definitions helps clarify how operating liabilities affect your company’s balance sheet.

Importance in Financial Management

Operating liabilities are essential for effective financial management. They influence liquidity ratios and cash flow statements, which help assess a company’s ability to meet its short-term obligations.

Moreover, managing operating liabilities efficiently can lead to better working capital management. This can enhance investment opportunities and improve overall profitability. Monitoring these obligations ensures you maintain healthy supplier relationships and avoid unnecessary interest costs on late payments.

Common Examples of Operating Liabilities

Operating liabilities represent short-term financial obligations essential for daily business operations. Understanding these examples helps you manage cash flow and ensure financial stability.

Accounts Payable

Accounts payable includes amounts owed to suppliers for goods and services received. You might encounter this liability when your company purchases inventory or materials but hasn’t yet paid the supplier. Typical terms could range from 30 to 90 days, allowing time for payment after receipt. Maintaining a healthy accounts payable balance is crucial, as it impacts liquidity ratios and can affect relationships with vendors.

Accrued Expenses

Accrued expenses are costs that have been incurred but not yet paid. For instance, if you accrue wages at the end of a pay period, those employee salaries become an operating liability until disbursed. Similarly, utilities or interest on loans may accumulate before payment deadlines. Recognizing accrued expenses ensures accurate financial reporting and planning for future outflows.

Deferred Revenue

Deferred revenue represents payments received in advance for services or products to be delivered later. For example, if customers subscribe to an annual service plan and prepay, those funds create a liability until you’ve fulfilled your obligation by providing the service. This accounting practice aligns income recognition with actual service delivery, improving your understanding of cash flow over time.

Impact on Business Operations

Operating liabilities play a critical role in shaping business operations. They directly affect cash flow, financial ratios, and overall financial health. Understanding their implications can enhance decision-making and operational efficiency.

Cash Flow Considerations

Cash flow management hinges on operating liabilities. For instance, accounts payable impact your outgoing cash flow by dictating when payments are due to suppliers. If you delay these payments within agreed terms, it may temporarily boost liquidity but strain vendor relationships over time. Additionally, accrued expenses like unpaid wages or utility bills represent obligations that require timely settlement to maintain smooth operations. Tracking deferred revenue is also vital; receiving payment upfront for future services affects cash flow projections significantly.

Financial Ratios and Analysis

Financial ratios often reflect the state of your operating liabilities. The current ratio, calculated by dividing current assets by current liabilities, helps assess short-term financial stability. A ratio below 1 indicates potential liquidity issues. Moreover, the quick ratio excludes inventory from current assets to provide a more stringent measure of liquidity risk related to operating liabilities. Regular analysis of these ratios offers insights into how effectively you’re managing obligations and maintaining operational efficiency as you strive for profitability.

Strategies for Managing Operating Liabilities

Managing operating liabilities effectively is crucial for maintaining financial health. Implementing targeted strategies can enhance your company’s liquidity and overall operational efficiency.

Best Practices for Reduction

To reduce operating liabilities, consider these practices:

- Negotiate payment terms: Extending payment deadlines with suppliers can improve cash flow and allow more time to generate revenue before settling debts.

- Prioritize payments: Focus on high-interest or critical obligations first, minimizing late fees and maintaining supplier relationships.

- Streamline purchasing processes: Consolidating purchases can lead to bulk discounts and reduced order frequency, lowering accounts payable.

- Monitor accrued expenses closely: Regularly review outstanding accrued expenses to ensure timely payments and accurate financial reporting.

Tools and Software Solutions

Utilizing the right tools enhances the management of operating liabilities. Here are some options:

- Accounting software: Programs like QuickBooks or Xero help track accounts payable, offering reminders for due dates.

- Cash flow management tools: Platforms such as Float provide insights into cash flow projections, helping you manage timing on payables effectively.

- Expense tracking applications: Apps like Expensify simplify expense reporting, ensuring all accrued costs are accurately recorded and paid in a timely manner.

By adopting these strategies and tools, you can maintain control over your operating liabilities while boosting your business’s overall financial performance.