In today’s digital age, understanding what qualifies as a digital asset is crucial for both individuals and businesses. But what exactly are these digital assets? From social media accounts to cryptocurrencies, the range of examples might surprise you.

Understanding Digital Assets

Digital assets encompass various forms of online property that hold value. These assets are crucial for both personal and business purposes. Here are some examples of digital assets you might encounter:

- Social Media Accounts: Platforms like Facebook, Twitter, and Instagram provide users with profiles containing valuable content and connections.

- Cryptocurrencies: Bitcoin and Ethereum represent a new form of currency that operates on blockchain technology.

- Websites: Your website can serve as a vital asset, housing your brand’s content, products, or services.

- Digital Content: This includes photos, videos, e-books, or music files created or owned by you.

Have you thought about how these assets contribute to your online presence? Each category plays a role in establishing identity and generating revenue.

Types of Digital Assets

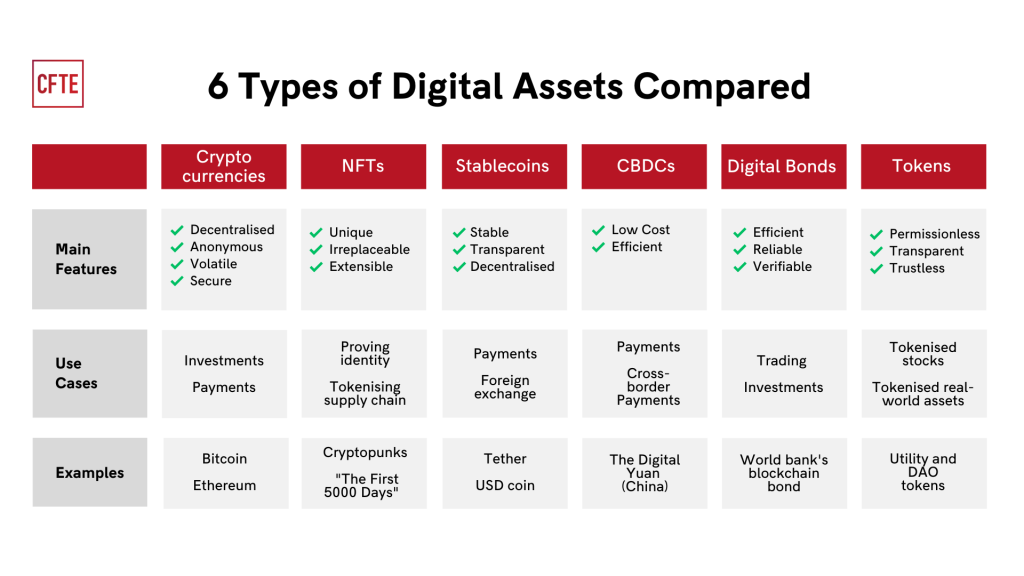

Digital assets come in various forms, each holding unique value in the online world. Understanding these types helps you leverage their potential effectively.

Cryptocurrency

Cryptocurrency acts as a digital currency that enables secure transactions. Examples include Bitcoin, Ethereum, and Litecoin. Each operates on blockchain technology, providing transparency and security. Many people invest in cryptocurrencies for long-term gains or use them for daily transactions, making them a significant part of the digital asset landscape.

Digital Media

Digital media encompasses various forms of content found online. This includes photos, videos, music files, and eBooks. For instance, platforms like YouTube house millions of video assets while Spotify offers extensive audio libraries. These assets not only entertain but also generate revenue through advertising and subscriptions.

Domain Names

Domain names represent your online identity and can be valuable assets. Think about how a memorable domain can enhance brand recognition. For example, domains like google.com or amazon.com are crucial to their respective brands’ success. Investing in desirable domain names often leads to significant returns if sold later or developed into functional websites.

Benefits of Digital Assets

Digital assets provide significant advantages for individuals and businesses. They enhance online visibility, streamline transactions, and create new revenue streams. Understanding these benefits can help you leverage digital assets effectively.

Accessibility

Digital assets offer unparalleled accessibility. You can access your content from anywhere with an internet connection. This flexibility allows for seamless collaboration among teams, regardless of location. For example:

- Social media platforms enable real-time engagement with audiences.

- Cloud storage services let you share files easily across devices.

- E-commerce websites allow customers to shop 24/7.

Given this ease of access, managing and utilizing digital assets becomes straightforward.

Security

Security is a crucial benefit of digital assets. Advanced technologies protect these assets against unauthorized access and theft. Utilizing encryption and secure platforms ensures that your data remains safe. Consider the following security measures:

- Blockchain technology offers transparency and security in cryptocurrency transactions.

- Password management tools safeguard sensitive information across multiple accounts.

- Regular software updates help defend against vulnerabilities in digital environments.

With robust security practices, you can focus on maximizing the value of your digital assets without constant worry about potential threats.

Challenges Associated with Digital Assets

Digital assets present unique challenges that can complicate their management and valuation. Understanding these issues is crucial for effective digital asset utilization.

Regulatory Issues

Regulatory frameworks surrounding digital assets are often unclear or evolving. Compliance with laws regarding data protection, taxation, and cryptocurrency varies by jurisdiction. For instance, if you operate a digital business, you must navigate local regulations while ensuring adherence to international standards. Additionally, some countries ban certain types of digital currencies altogether. This inconsistency can create uncertainty for investors and businesses alike.

Market Volatility

Market volatility significantly impacts the value of many digital assets, particularly cryptocurrencies. Prices can fluctuate wildly in short periods due to market sentiment, technological changes, or regulatory news. For example:

- Bitcoin has seen price swings exceeding 20% within days.

- Ethereum’s value has fluctuated dramatically based on network upgrades and competition.

This unpredictability makes it challenging to assess the long-term potential of your investments in these assets. Additionally, high volatility may deter traditional investors from entering the digital space, limiting overall market growth.