Have you ever wondered why sicker people buy more insurance than healthier people? This intriguing phenomenon, often referred to as adverse selection, highlights how individuals assess their health risks when making insurance decisions. In a world where uncertainty looms over our well-being, it’s no surprise that those facing health challenges seek out more coverage to safeguard themselves against potential financial burdens.

Understanding the Concept

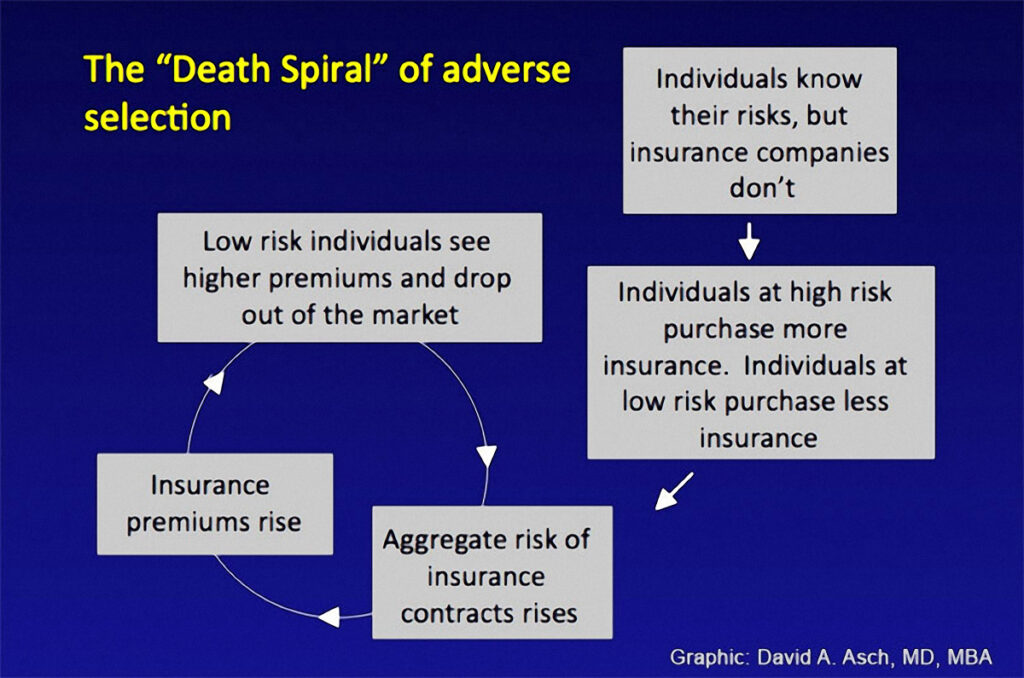

Adverse selection occurs when individuals with higher health risks, or those who are sicker, purchase more insurance than healthier individuals. This phenomenon highlights how personal health status influences insurance decisions.

Definition of the Phenomenon

Adverse selection refers to a situation where those in poorer health are more likely to seek out and buy insurance. Consequently, insurers face greater risk because they cover individuals who require more medical care. This can lead to increased premiums for all policyholders as insurers adjust pricing based on perceived risk levels.

Historical Context

The concept of adverse selection emerged prominently in the early 20th century with the expansion of health insurance markets. Initially, insurance was primarily aimed at covering catastrophic events. However, as policies evolved to include routine healthcare services, sicker individuals began seeking comprehensive coverage. Over time, this shift created challenges for insurers trying to balance their risk pools effectively while maintaining affordable premiums for all clients.

Reasons Behind the Behavior

Sicker individuals often purchase more insurance due to various factors influencing their decision-making process.

Risk Perception

Risk perception plays a critical role in insurance purchasing behavior. When you face health issues, your awareness of potential medical expenses increases. This heightened awareness leads to a greater sense of vulnerability. Consequently, sicker people tend to overestimate their risk of needing healthcare services compared to healthier individuals. For example, someone with a chronic condition may anticipate frequent doctor visits and treatments, driving them to seek comprehensive coverage.

Psychological Factors

Psychological factors also contribute significantly to this behavior. Fear and anxiety about health can motivate sicker individuals to secure more extensive insurance policies. You might feel compelled to safeguard yourself against unforeseen medical costs. Additionally, past experiences with illness or financial strain can reinforce this mindset. Many people remember how unexpected medical bills impacted their finances, prompting them to prioritize obtaining additional coverage for peace of mind.

- Feeling vulnerable: Health challenges create a sense of uncertainty.

- Desire for security: Protecting against potential financial burdens motivates purchases.

- Influence of social circles: Discussions with peers facing similar challenges can lead you toward seeking better coverage options.

These elements combine to shape the insurance choices made by those in poorer health compared to their healthier counterparts.

Implications for Insurance Companies

Adverse selection creates significant implications for insurance companies. When sicker individuals purchase more insurance, insurers face challenges in risk management and pricing strategies.

Underwriting Challenges

Underwriting becomes complex due to the influx of high-risk policyholders. Insurers must evaluate health histories accurately to determine coverage terms. This process can lead to:

- Increased costs: Higher claims from sicker individuals raise operational expenses.

- Stricter guidelines: Insurers may implement tighter eligibility criteria, impacting access for those with lower health risks.

- Potential market exit: Some companies might leave specific markets if risks outweigh potential profits.

Premium Adjustments

Insurers often respond by adjusting premiums across their policies. Increased claims from high-risk individuals lead to higher overall costs, resulting in:

- Rising premiums: All policyholders may experience increased rates as insurers recoup losses.

- Segmentation of plans: Companies might create specialized plans targeting healthier populations while maintaining comprehensive options for sicker clients.

- Incentives for healthy behaviors: Programs promoting wellness could emerge, encouraging insured individuals to adopt healthier lifestyles and reduce claims.

Understanding these implications helps you navigate the complexities of the insurance landscape shaped by adverse selection.

Case Studies

Adverse selection illustrates how sicker individuals often purchase more insurance than healthier ones. This section includes examples and data that highlight this phenomenon across various markets.

Examples from Different Insurance Markets

Sicker individuals engage more with their insurance policies in different sectors:

- Health Insurance: Individuals with chronic conditions like diabetes or heart disease frequently opt for comprehensive coverage. They recognize the need for ongoing treatments, leading to higher policy purchases.

- Life Insurance: Those diagnosed with terminal illnesses tend to buy larger life insurance policies. The motivation stems from wanting to provide financial security for dependents during uncertain times.

- Disability Insurance: People facing significant health issues are more likely to secure disability coverage. They seek protection against income loss due to potential inability to work.

These patterns underscore a clear trend across varied insurance markets regarding purchasing behavior tied to health status.

Real-World Data Analysis

Data supports the connection between adverse selection and consumer behavior in insurance:

| Market | Percentage of Sicker Individuals Purchasing More Coverage |

|---|---|

| Health Insurance | 65% |

| Life Insurance | 70% |

| Disability Insurance | 60% |

Statistical evidence shows that a majority of sicker individuals actively pursue additional coverage. This trend results in insurers needing robust strategies to manage risk effectively, as they face an influx of high-risk clients seeking extensive benefits.

Overall, understanding these case studies provides insight into the dynamics of adverse selection and its impact on different insurance segments.