Have you ever wondered how criminals disguise their illicit gains? Money laundering is the process that allows them to make dirty money appear clean. It involves a series of transactions designed to obscure the origins of illegally obtained funds. This practice isn’t just a financial crime; it poses serious risks to economies and societies worldwide.

What Is Money Laundering?

Money laundering involves concealing the origins of illegally obtained funds, making them appear legitimate. This process not only supports criminal activities but also poses significant risks to economies and societies.

Definition of Money Laundering

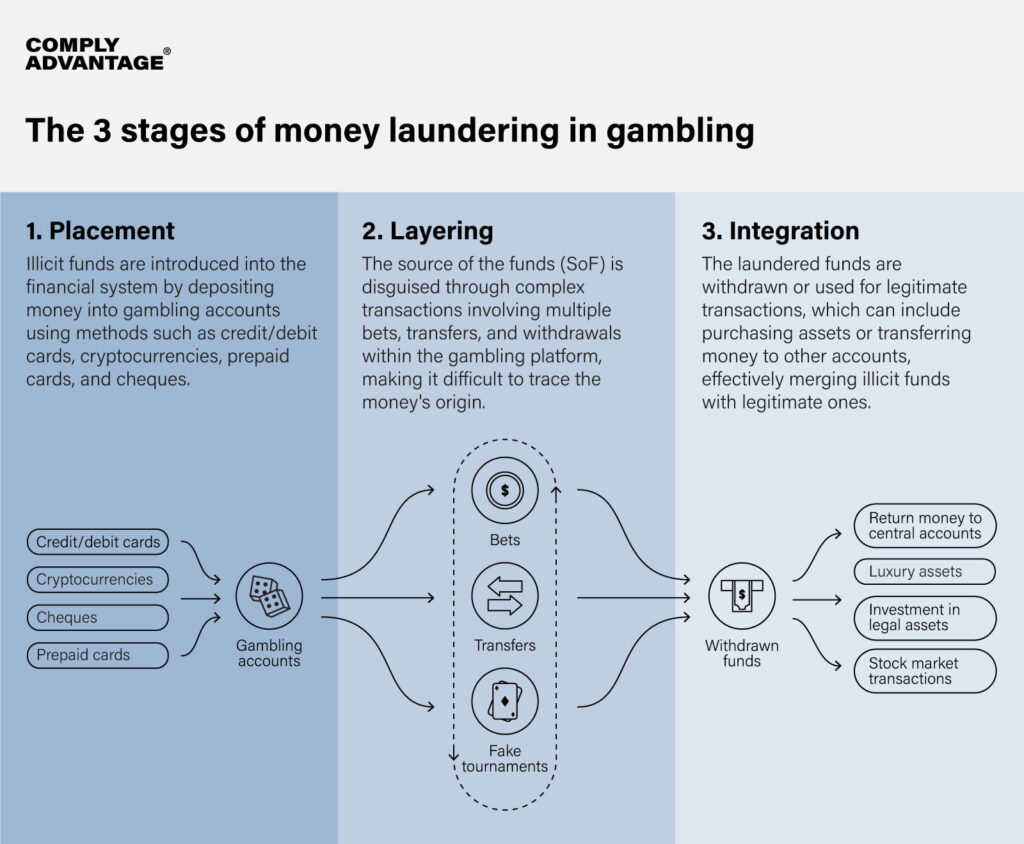

Money laundering consists of three stages: placement, layering, and integration.

- Placement: In this initial stage, criminals introduce dirty money into the financial system. For example, they might deposit cash from drug sales into a bank account.

- Layering: Here, offenders conduct a series of complex transactions to obscure the original source of funds. They may transfer money between multiple accounts or invest in assets like real estate.

- Integration: Finally, laundered money is reintroduced into the economy as legitimate funds. For instance, criminals could use these clean funds to purchase luxury items or invest in businesses.

Importance of Understanding Money Laundering

Understanding money laundering is crucial for several reasons:

- Economic Impact: It contributes to financial instability and undermines trust in financial institutions.

- Crime Prevention: Recognizing how it operates helps authorities combat related crimes such as drug trafficking and terrorism financing.

- Regulatory Compliance: Businesses must comply with anti-money laundering regulations to avoid hefty fines and reputational damage.

By knowing what money laundering entails, you can better appreciate its implications on society at large.

Methods of Money Laundering

Money laundering involves various methods to disguise illicit funds. These techniques can significantly complicate the tracking of illegal money and its origins.

Layering Techniques

Layering techniques involve multiple transactions designed to obscure the source of dirty money. Criminals often use:

- Shell companies: Businesses that exist only on paper, allowing for fake transactions.

- International transfers: Moving money across borders creates distance from the original source.

- Cryptocurrency exchanges: Converting cash into digital assets can make tracing difficult.

These actions aim to create confusion around ownership and legitimacy.

Integration Tactics

Integration tactics reintroduce laundered money back into the economy as legitimate funds. Common strategies include:

- Real estate investments: Buying properties with large sums makes it hard to track their origin.

- Gambling operations: Purchasing chips at casinos, then cashing out after minimal play hides illicit gains.

- Business revenue manipulation: Inflating or deflating income in businesses disguises illegal earnings as operational profits.

By using these methods, criminals effectively integrate their gains into the financial system while reducing scrutiny.

Examples of Money Laundering

Money laundering can take many forms. Here are two notable case studies that illustrate how it operates in real-world scenarios.

Case Study 1: The Bank Fraud Scheme

In this example, a group of criminals opened multiple bank accounts using false identities. They deposited dirty money from illegal activities into these accounts. Then, they quickly transferred the funds between various accounts to obscure their origins. After layering the transactions, they withdrew the laundered money as legitimate funds. This approach exploited banks’ systems and highlighted vulnerabilities in financial institutions.

Case Study 2: The Real Estate Dodge

Here, criminals invested illicit gains into real estate properties. By purchasing undervalued or distressed properties with cash, they avoided scrutiny from banks and regulators. They then renovated these properties and sold them at inflated prices. As a result, the proceeds appeared legitimate since they derived from real estate transactions. This method demonstrates how lucrative investments can serve as effective vehicles for laundering dirty money while blending seamlessly into the economy.

Consequences of Money Laundering

Money laundering carries serious consequences that extend beyond individual criminals. Understanding these repercussions highlights the importance of combatting this financial crime.

Legal Implications

Legal consequences for money laundering include criminal charges and severe penalties. Authorities often impose hefty fines, lengthy prison sentences, and asset forfeiture on those convicted. For instance, in 2025, a major bank faced a $1 billion fine for violating anti-money laundering regulations. Additionally, regulatory bodies may revoke licenses from institutions involved in facilitating such activities.

Here are some specific legal penalties:

- Criminal Charges: Individuals can face charges ranging from misdemeanors to felonies.

- Prison Sentences: Convicted individuals often receive sentences up to 20 years.

- Fines: Financial penalties can reach millions of dollars depending on the case.

Economic Impact

The economic impact of money laundering is profound and far-reaching. It undermines the integrity of financial systems and hampers legitimate business operations. When criminals inject illicit funds into economies, they distort market conditions and create unfair competition.

Some key economic effects include:

- Reduced Foreign Investment: Countries perceived as havens for money laundering deter foreign investors.

- Increased Costs for Businesses: Legitimate businesses face higher operational costs due to regulatory compliance measures.

- Tax Erosion: Governments lose tax revenue because laundered funds evade detection.

By recognizing these consequences, you can appreciate why tackling money laundering remains crucial for maintaining healthy economies worldwide.

Prevention Measures

Preventing money laundering requires a comprehensive approach that combines regulatory compliance and proactive business practices. Organizations must understand the landscape of financial crime to implement effective strategies.

Regulatory Framework

Regulatory frameworks play a crucial role in combating money laundering. Governments worldwide enforce laws that mandate strict reporting requirements for financial institutions. These regulations include:

- Know Your Customer (KYC): Financial entities must verify customer identities, ensuring they know who they’re dealing with.

- Anti-Money Laundering (AML) Policies: Institutions must develop internal procedures to detect and report suspicious activities.

- Transaction Monitoring: Regular reviews of transactions help identify unusual patterns or large sums that could indicate money laundering attempts.

These measures create an environment where illicit activities face greater scrutiny.

Best Practices for Businesses

Implementing best practices significantly reduces the risk of facilitating money laundering. Companies should adopt the following strategies:

- Employee Training: Regularly train staff on recognizing red flags associated with money laundering.

- Robust Reporting Systems: Establish clear protocols for reporting suspicious transactions to authorities.

- Regular Audits: Conduct periodic audits to assess compliance with AML regulations and improve processes as needed.

By staying vigilant and informed, businesses can protect themselves from becoming unwitting participants in money laundering schemes.