Have you ever wondered how large corporations manage to expand their reach while maintaining control? A subsidiary of a company plays a crucial role in this strategy. Essentially, it’s a separate entity owned or controlled by a parent company, allowing for greater flexibility and risk management.

Understanding Subsidiaries

A subsidiary refers to a distinct entity controlled by a parent company. This structure allows companies to expand while managing risks effectively.

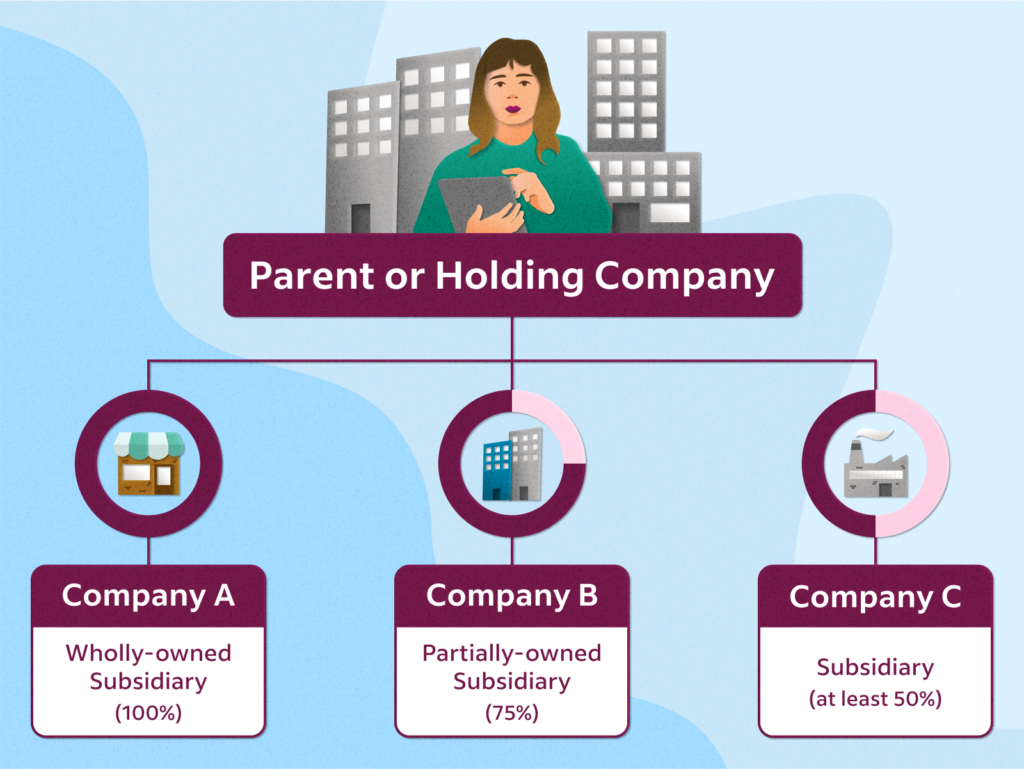

Definition of a Subsidiary

A subsidiary is an organization that is at least 50% owned or controlled by another company, known as the parent. The parent possesses significant control over the subsidiary’s operations and decisions, yet the subsidiary maintains its legal identity. For example, if Company A owns 70% of Company B, then Company B qualifies as a subsidiary of Company A.

Importance of Subsidiaries in Business

Subsidiaries play a critical role in business strategies. They provide several advantages:

- Risk Management: By segmenting operations into subsidiaries, companies can limit their financial exposure.

- Market Expansion: Companies often create subsidiaries to enter new geographical markets or sectors.

- Regulatory Compliance: Different countries have unique regulations; subsidiaries help navigate these complexities.

- Resource Allocation: Parent companies can allocate resources more efficiently across different subsidiaries based on performance.

These factors contribute significantly to why many large corporations opt for this organizational structure.

Types of Subsidiaries

Subsidiaries come in different forms, each with its own characteristics and advantages. Understanding these types helps you grasp how they fit into a company’s overall strategy.

Wholly Owned Subsidiaries

A wholly owned subsidiary is entirely owned by the parent company. The parent holds 100% of the shares, granting full control over operations and decisions. For instance, Google’s ownership of YouTube exemplifies this type, as Google manages all aspects without outside influence. Other examples include:

- Facebook’s acquisition of Instagram

- Dell Technologies’ purchase of VMware

These companies benefit from having complete authority to implement their strategies effectively.

Partially Owned Subsidiaries

A partially owned subsidiary involves shared ownership between the parent company and other investors or entities. The parent company typically holds more than 50% but less than 100% of the shares. An example is Ford Motor Company’s stake in Changan Automobile, which allows Ford to maintain significant influence while engaging in joint ventures. Additional examples include:

- Sony’s investment in Sony Music Entertainment

- Nestlé’s shareholding in Starbucks

Such subsidiaries enable companies to collaborate while still exercising considerable control over strategic directions.

Legal and Financial Implications

Understanding the legal and financial implications of a subsidiary is crucial for effective business management. Subsidiaries operate as separate legal entities, which impacts governance and fiscal responsibility.

Legal Structure and Governance

A subsidiary’s legal structure allows it to function independently from its parent company. This independence means that subsidiaries can enter contracts, own assets, and incur liabilities without directly involving the parent company. For instance, Coca-Cola Enterprises operates as a subsidiary of The Coca-Cola Company; it manages its operations while adhering to corporate governance standards set by the parent.

This structure protects the parent company’s assets from liabilities incurred by the subsidiary. In cases like General Electric, their subsidiaries must comply with local laws where they operate, ensuring adherence to regulations across different jurisdictions.

Financial Reporting and Taxation

Financial reporting for subsidiaries involves distinct requirements based on ownership stakes. If you own over 50%, you consolidate financial statements into your accounts. Consider Procter & Gamble, which consolidates results from its subsidiaries like Gillette, reflecting their complete control.

Tax implications also vary significantly for subsidiaries. They may face different tax rates depending on their location or operational model. For example, Apple’s international subsidiaries benefit from favorable tax regimes in specific countries, optimizing overall tax liability while adhering to each jurisdiction’s laws.

Both legal structure and financial reporting shape how a subsidiary operates within its parent’s framework while maintaining compliance with relevant laws and regulations.

Advantages of Having a Subsidiary

Subsidiaries offer numerous advantages to parent companies, enhancing their overall business strategy.

Risk Management

Risk management becomes more effective with subsidiaries. By separating operations, the parent company reduces exposure to potential losses from one specific market or venture. For example, if a subsidiary faces financial difficulties, it won’t directly impact the parent company’s assets. This structure protects your investment and allows each subsidiary to address risks specific to its industry without involving the entire corporation.

Market Expansion

Market expansion is significantly easier through subsidiaries. You can enter new geographical regions or sectors by establishing local subsidiaries that understand and navigate regional regulations and consumer preferences. A case in point is Starbucks; they often open local branches in different countries, adapting their menu to fit local tastes while maintaining brand consistency. This strategy not only boosts sales but also enhances brand visibility globally.

Challenges of Managing Subsidiaries

Managing subsidiaries presents a range of challenges that require careful consideration and strategic planning. These challenges can impact overall business operations and necessitate a proactive approach from parent companies.

Operational Control

Maintaining effective operational control over subsidiaries proves crucial for parent companies. Parent organizations often face difficulties in ensuring that subsidiaries adhere to corporate policies and standards. For instance, if a subsidiary operates in a different country, local regulations may differ significantly. This can lead to inconsistencies in operations, potentially affecting brand reputation. Additionally, monitoring performance metrics across various subsidiaries requires robust systems to track objectives effectively.

Cultural Differences

Cultural differences between the parent company and its subsidiaries create management complexities. Variations in communication styles, work ethics, and decision-making processes can hinder collaboration. For example, a U.S.-based parent company might find it challenging to navigate hierarchical structures prevalent in Asian markets. Understanding these cultural nuances is essential for fostering teamwork and integration across all levels of the organization. Furthermore, providing training on cultural sensitivity can bridge gaps and improve employee relations within global teams.