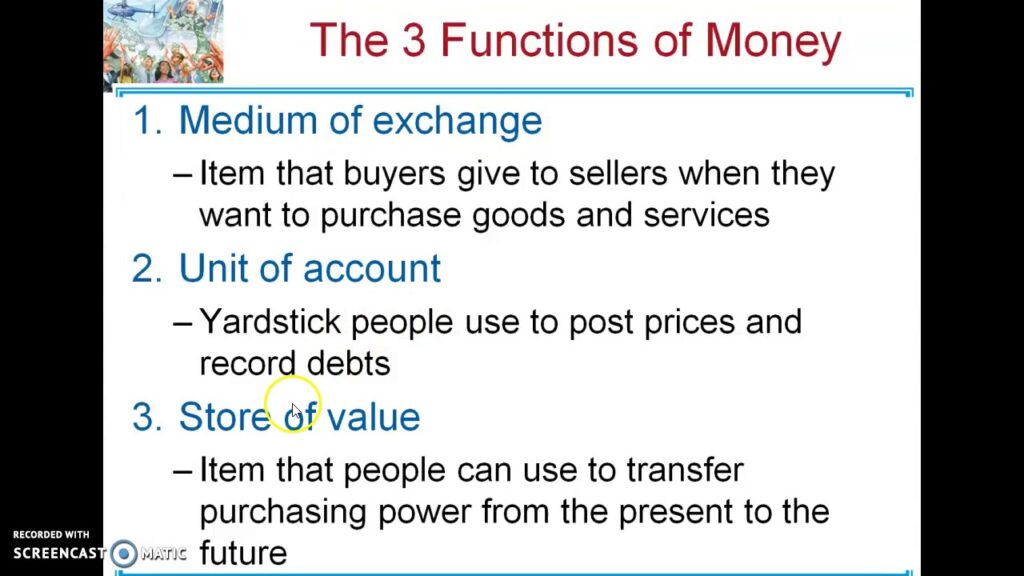

Money plays a crucial role in our daily lives, yet many people overlook its fundamental functions. Have you ever wondered why money is so essential? Understanding what the three functions of money are can illuminate how it shapes economies and influences your financial decisions.

Overview of Money

Money serves as a vital component in economic systems. It acts primarily as a medium of exchange, making transactions smoother. Instead of bartering goods, you can use money to buy what you need directly. For example, purchasing groceries with cash or credit cards simplifies trade.

Money also functions as a unit of account. This means it provides a standard measure for valuing goods and services. When you see prices displayed in dollars, it allows for easy comparison among different products. Think about how much simpler it is to evaluate whether an item is worth buying when its price is clearly marked.

Lastly, money serves as a store of value. You can save money for future purchases without worrying about its degradation over time. For instance, keeping your savings in a bank account helps maintain its value compared to holding physical items that might lose worth.

Understanding these three key functions clarifies why money plays such an important role in daily life and the economy at large.

What Are the Three Functions of Money?

Understanding the three functions of money is crucial for grasping its role in everyday transactions and economic systems. Each function highlights a unique aspect of how money facilitates trade and value assessment.

Medium of Exchange

Money acts as a medium of exchange, simplifying transactions between buyers and sellers. Instead of bartering goods directly, you use currency to buy items. For example, if you want groceries, you pay with cash or a credit card instead of trading products like eggs or bread. This efficiency streamlines commerce and fosters broader market participation.

Unit of Account

Money serves as a unit of account, providing a consistent measure for valuing goods and services. Prices displayed in dollars make it easy to compare costs across different products. You can determine whether one brand offers better value than another simply by looking at their prices. This function enhances decision-making and budgeting by establishing clear standards for financial exchanges.

Store of Value

Money functions as a store of value, allowing individuals to save wealth for future use. Unlike perishable goods that lose value over time, cash retains purchasing power when stored appropriately. For instance, saving $100 now means you can spend it later without worrying about significant depreciation—provided inflation remains stable. This ability to preserve wealth encourages saving behaviors among individuals and families.

Importance of Each Function

Understanding the importance of money’s functions enhances your grasp of its role in daily transactions and economic systems.

Role in Modern Economy

Money acts as a medium of exchange, facilitating trade by providing a common ground for buying and selling goods. Instead of bartering, you can use currency, making transactions smoother. For example, when you go to a grocery store, you don’t need to exchange apples for bread; instead, you pay with cash or card. This efficiency encourages more people to participate in the economy.

Impact on Trade and Commerce

Money significantly influences trade and commerce by serving as a unit of account. It allows businesses to price their products consistently. For instance, if one shirt costs $20 and another costs $30, the clear pricing helps you decide which one offers better value. Additionally, it helps companies track income and expenses easily. By using money effectively, businesses can make informed decisions that drive growth and profitability.