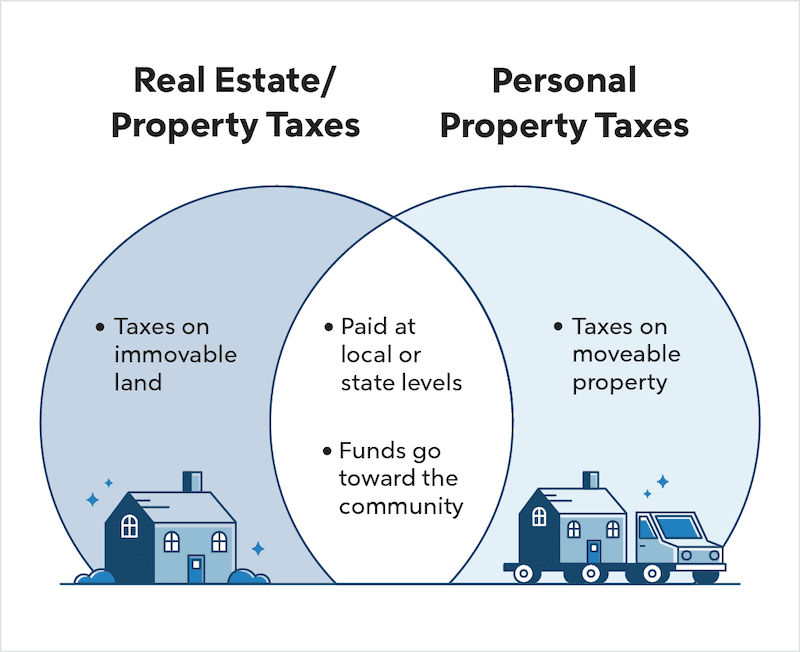

Imagine receiving a bill that reflects the value of your belongings. That’s exactly what personal property taxes do. Personal property taxes are levies imposed on movable assets like vehicles, furniture, and equipment. These taxes can vary significantly depending on where you live and the items you own.

Overview Of Personal Property Taxes

Personal property taxes apply to various movable assets. These taxes can impact your financial obligations depending on the items you own and your location. Here are some examples of taxable personal properties:

- Vehicles: Cars, trucks, motorcycles, and boats often incur personal property taxes based on their assessed value.

- Furniture: Items like couches, tables, and beds may be taxed in certain jurisdictions where they count as personal property.

- Equipment: Business-related equipment such as computers and machinery typically falls under this tax category.

Tax rates vary significantly across states and municipalities. This variation means that two individuals with similar assets might face different tax bills simply due to their locations. Additionally, certain exemptions might exist; for instance:

- Agricultural Equipment: Some regions exempt farming tools from taxation if used primarily for agricultural purposes.

- Non-profit Organizations: Assets owned by non-profits may also receive tax relief in various localities.

Understanding the specifics of personal property taxes helps you make informed decisions about asset ownership. Always check your local regulations for accurate information regarding what qualifies for taxation in your area.

Types Of Personal Property Taxes

Personal property taxes can primarily be categorized into two types: tangible and intangible personal property. Understanding these categories helps clarify which assets are subject to taxation.

Tangible Personal Property

Tangible personal property includes physical items you own that can be touched or moved. Common examples of tangible personal property include:

- Vehicles: Cars, trucks, motorcycles, boats.

- Furniture: Couches, tables, chairs.

- Equipment: Computers, machinery used for business purposes.

Tangible personal property taxes vary by location, impacting the tax rate based on local regulations. Some states impose higher rates on vehicles compared to furniture or equipment.

Intangible Personal Property

Intangible personal property consists of non-physical assets that hold value but cannot be physically touched. Examples include:

- Stocks and bonds

- Patents and trademarks

- Business goodwill

Intangible personal property can also incur taxes, depending on state laws. For instance, some jurisdictions tax certain financial instruments while others may not. Checking local tax codes ensures you’re aware of any applicable taxes on your intangible assets.

How Personal Property Taxes Are Assessed

Personal property taxes are assessed based on the value of your movable assets. Local tax authorities determine this value, which can fluctuate based on several factors. Understanding how personal property taxes are calculated helps you prepare for potential costs.

Determining Property Value

Tax assessors evaluate personal property through various methods. They might consider:

- Market value: The price a similar asset would fetch in the marketplace.

- Replacement cost: The expense to replace an item with a new one of similar utility and quality.

- Depreciation: An adjustment reflecting the decrease in value over time due to wear and tear.

These assessments ensure that tax bills reflect fair values.

Tax Rates And Exemptions

Tax rates vary significantly across jurisdictions. Factors influencing these rates include:

- Local government policies: Each municipality sets its own rate, impacting your overall tax burden.

- Type of property: Different assets may have different assessment rates; for instance, vehicles often face higher rates than furniture.

Certain exemptions apply, such as:

- Agricultural equipment: Often exempt if used primarily for farming activities.

- Non-profit organization assets: Many non-profits benefit from exemption status, reducing their taxable obligations.

Understanding these elements helps you navigate your responsibilities regarding personal property taxes effectively.

Importance Of Personal Property Taxes

Personal property taxes contribute significantly to local economies. These taxes provide funding for essential services like schools, public safety, and infrastructure maintenance. Since these funds directly impact your community’s quality of life, understanding personal property taxes is crucial.

Tax revenue helps maintain public services. Local governments rely on this revenue to support fire departments, police services, and road repairs. Without adequate funding from personal property taxes, these vital services might face cuts or reduced effectiveness.

You may also benefit from local initiatives. Programs funded by personal property tax revenues can include parks, libraries, and community centers. Your investment in personal property taxes fosters a thriving environment where you live and work.

The variability in tax rates across different regions highlights the importance of knowing your local laws. Not every jurisdiction imposes the same rates or exemptions on personal properties. Checking with your local tax authority ensures you’re aware of any unique regulations that may apply to you.

Additionally, recognizing how personal property taxes affect asset valuation is key. The value assigned to your assets influences not only your tax burden but also potential resale values when selling items like vehicles or business equipment. Understanding this connection enhances informed decision-making regarding ownership and sales strategies.

Lastly, considering exemptions can save money for many individuals and businesses. Some states offer exemptions for specific categories of personal property—like agricultural equipment—reducing overall tax liabilities. Always explore available options that could lessen your financial responsibilities related to personal property taxation.