In a world where economic landscapes shift rapidly, the notion of diversification for stability as a valid argument for protection in the US sparks intense debate. Can diversifying industries and resources truly safeguard against unforeseen economic downturns? As you delve into this topic, you’ll uncover various perspectives that challenge or support this argument.

This article will explore real-world examples and expert opinions to determine whether diversification genuinely enhances stability. From agriculture to technology sectors, how does spreading risk impact overall economic health? By examining case studies and historical data, you’ll gain insights into the effectiveness of this strategy in protecting the US economy. Prepare to engage with thought-provoking questions and discover if the diversification for stability argument holds water in today’s complex economic climate.

Overview of the Diversification for Stability Argument

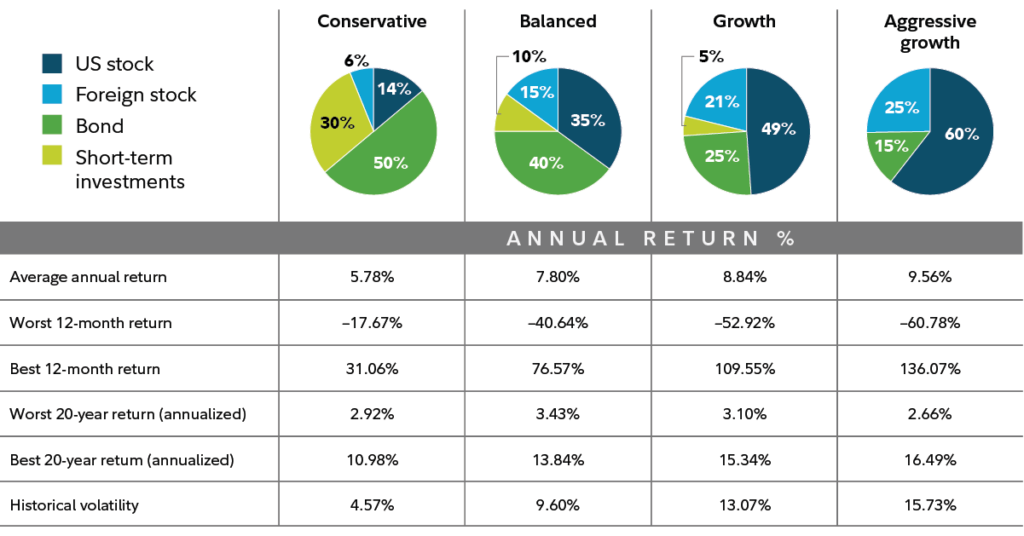

Diversification as a strategy for economic stability involves spreading investments across various industries and sectors. This approach aims to reduce risk during economic fluctuations. Evaluating its validity requires examining historical contexts and modern implications.

Historical Context

Historically, the US economy has seen periods where diversification played a crucial role in stability. For instance, during the 2008 financial crisis, companies that operated in multiple sectors managed to weather the storm better than those focused solely on one industry. A few key examples include:

- General Electric: With interests in healthcare, energy, and aviation, GE showcased resilience compared to competitors limited to singular markets.

- Procter & Gamble: This consumer goods giant thrived by diversifying its product lines across personal care and household items.

These instances highlight how diversification helped mitigate risks during turbulent times.

Modern Implications

In today’s complex economy, the relevance of diversification remains significant. Many businesses adopt this strategy to safeguard against market volatility. Consider these points:

- Technological Advances: Companies like Amazon expand into cloud computing while maintaining their retail base.

- Global Supply Chains: Firms diversify suppliers from different regions to minimize disruptions from geopolitical issues or natural disasters.

It becomes clear that diversification not only fosters stability but also encourages growth amid uncertainty.

Key Arguments Supporting Diversification

Diversification plays a crucial role in enhancing economic stability. By spreading investments across various sectors, you minimize risks associated with downturns in specific industries.

Economic Stability Through Diversification

Economic stability often hinges on diversification strategies. For instance, during the 2008 financial crisis, companies like General Electric maintained stronger positions due to their diversified portfolios. They operated in multiple sectors, which cushioned them against adverse impacts in any single area. Similarly, Procter & Gamble demonstrated resilience by offering a range of products from household goods to personal care items, ensuring steady revenue streams despite market fluctuations.

Risk Management and Resilience

Risk management becomes more effective through diversification. When you invest in varied industries, potential losses from one sector can be offset by gains in another. An example includes Amazon, which has branched out from e-commerce into cloud computing and streaming services. This strategy not only mitigates risks but also fosters growth opportunities during uncertain times. Additionally, businesses that embrace diversification often exhibit greater resilience; they adapt better to changing market conditions and consumer demands, ultimately leading to sustained success.

Counterarguments Against Diversification

The diversification strategy, often touted for its stability benefits, faces significant scrutiny. Critics argue that diversifying investments or industries might not always lead to the desired resilience against economic fluctuations.

Potential Downsides of Diversified Approaches

Diversification can dilute focus and resources. When companies spread themselves too thin across various sectors, they may struggle to maintain quality and innovation in any single area. Additionally, managing diverse operations increases complexity, which can hinder decision-making processes. You might wonder how this impacts profitability; less attention on core competencies often results in reduced effectiveness overall.

Case Studies of Failure

Several examples illustrate the pitfalls of excessive diversification:

- General Motors: Once a leader in the automotive industry, GM’s venture into unrelated sectors like financial services led to distractions that contributed to its 2009 bankruptcy.

- Yahoo!: The company diversified into numerous markets without a clear strategy. This lack of focus resulted in missed opportunities and eventual decline as competitors captured market share.

- Quaker Oats: After acquiring Snapple in 1994, Quaker struggled to integrate the brand effectively. The acquisition ultimately failed, leading Quaker to sell Snapple just three years later at a loss.

These cases highlight that while diversification aims for stability, it can also backfire if not executed with strategic intent and clarity.

Evaluation of the Validity in the U.S. Context

The argument for diversification as a means to achieve economic stability holds significant weight in the U.S. context. You can see how various industries and companies have used this strategy to weather economic storms.

Comparison with Other Nations

Diversification strategies vary across countries, influencing their economic resilience. For instance, Germany’s diversified manufacturing base allows it to mitigate risks associated with specific sectors. In contrast, countries heavily reliant on single industries, such as oil-producing nations, often face severe downturns during price drops.

Consider these examples:

- Norway: The economy relies on oil exports, making it vulnerable to global price fluctuations.

- Japan: Its diverse technology sector contributes to more stable growth compared to countries dependent on specific resources.

Understanding how different nations approach diversification helps highlight its importance in maintaining stability.

Impact on U.S. Policy and Economy

U.S. policies often promote diversification through incentives for small businesses and investment strategies aimed at fostering innovation across multiple sectors. This encouragement leads to increased job creation and overall economic resilience.

Take a look at key points:

- Tax incentives for startups encourage investments across various industries.

- Trade policies that support diversified imports help stabilize domestic markets.

Additionally, diversification impacts financial markets by reducing volatility during crises, allowing investors greater confidence in varied portfolios. As you analyze these factors, note how they shape the broader conversation about economic stability through diversification strategies in the U.S.