Imagine discovering that the items you own could impact your tax bill. Tangible personal property tax is a crucial aspect of property taxation that many overlook. This type of tax applies to physical assets like machinery, furniture, and equipment, which can significantly affect both individuals and businesses.

Overview Of Tangible Personal Property Tax

Tangible personal property tax applies to various physical assets you own. This tax impacts individuals and businesses alike, so understanding it is crucial. Here are some examples of items typically subject to this tax:

- Machinery: Equipment used in manufacturing or production processes.

- Furniture: Office desks, chairs, and other furnishings in your business or rental properties.

- Vehicles: Cars, trucks, and boats owned for business purposes.

- Tools: Hand tools and power tools utilized for work or trade.

Each state has its own rules regarding the assessment of tangible personal property. You might find that some jurisdictions provide exemptions based on specific criteria. For instance, small businesses often receive relief if their total asset value falls below a certain threshold.

In addition to these examples, consider how depreciation affects taxation. As your assets age, their value decreases which can lower your overall tax liability. It’s essential to keep accurate records of all tangible personal property you own to ensure compliance with local regulations.

Have you assessed all your physical assets? Regularly reviewing them helps avoid surprises during tax season. Understanding how tangible personal property tax works ensures you’re prepared when filing returns each year.

Importance Of Tangible Personal Property Tax

Tangible personal property tax plays a crucial role in funding local services and impacting business operations. Understanding its significance helps you navigate financial responsibilities effectively.

Impact On Local Governments

Local governments rely on tangible personal property tax for essential services. This tax contributes to:

- Public safety: Funding police, fire departments, and emergency services.

- Infrastructure: Supporting road maintenance, public transportation, and utilities.

- Education: Financing schools and educational programs.

Without this revenue, local governments might struggle to provide necessary services that improve community quality of life.

Effects On Business Owners

For business owners, tangible personal property tax impacts financial planning. It affects your bottom line when considering:

- Asset valuation: Higher asset values can lead to increased tax bills.

- Depreciation strategies: Aging assets decrease in value, potentially lowering tax liability.

- Exemptions: Some states offer exemptions for small businesses with limited assets.

Being aware of these factors allows you to make informed decisions about asset acquisition and management.

Assessing Tangible Personal Property Tax

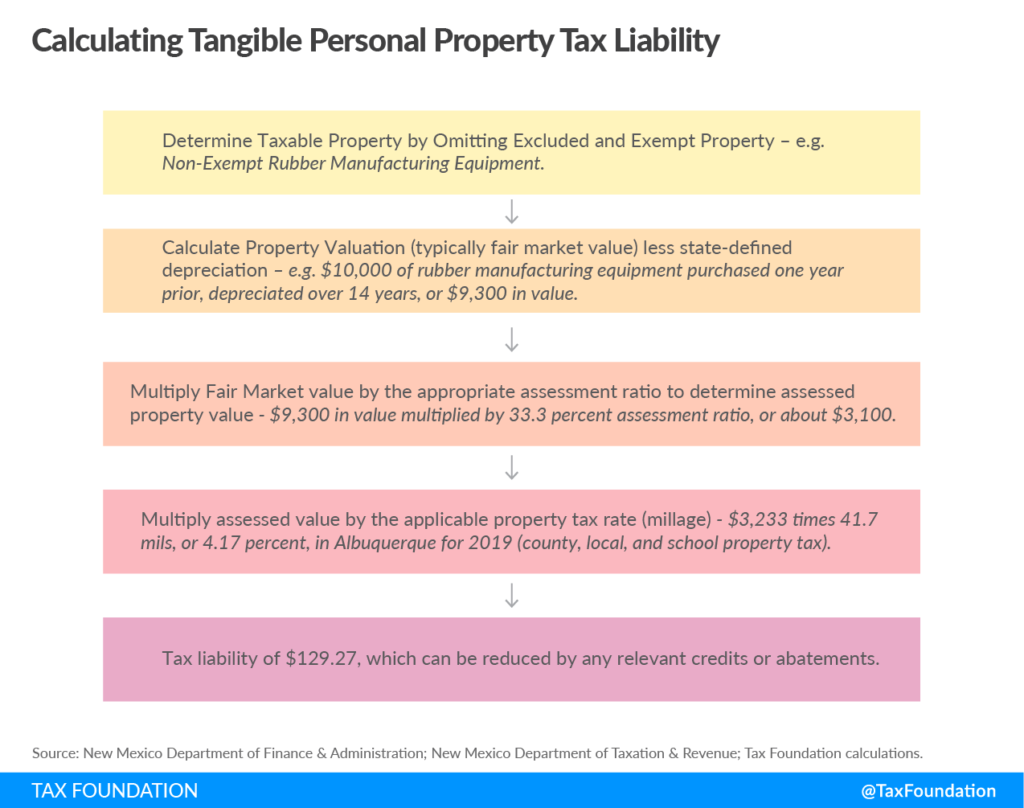

Assessing tangible personal property tax involves understanding how to determine the value of physical assets and identifying potential exemptions. The process varies by state, so it’s crucial to familiarize yourself with local regulations.

Valuation Methods

Valuation methods for tangible personal property typically include three approaches:

- Cost Approach: This method calculates the current cost to replace an asset minus depreciation. For example, if a piece of machinery costs $10,000 and has depreciated by $4,000 over time, its assessed value is $6,000.

- Market Approach: Here, you compare similar items in the market to establish a fair value. If comparable equipment sells for about $8,000 in your area, it can guide your asset valuation.

- Income Approach: This approach evaluates the income generated by an asset over time. If a vehicle generates $2,500 annually through deliveries and has a useful life of 5 years left, its present value could be calculated based on that income stream.

Exemptions And Deductions

Many states offer exemptions and deductions that can significantly lower your taxable amount:

- Small Business Exemption: Some states allow small businesses with assets below a certain threshold—often around $10,000—to be exempt from this tax.

- Agricultural Equipment Deduction: In many areas, agricultural tools or machinery might qualify for specific deductions due to their role in food production.

- Personal Property Exemptions: Certain items like household goods or vehicles used solely for personal use often don’t fall under taxation rules.

By understanding these aspects of tangible personal property tax assessment, you can better manage your financial responsibilities while potentially reducing your tax liability.

Challenges In Tangible Personal Property Tax

Tangible personal property tax presents several challenges for both individuals and businesses. These challenges often stem from compliance issues and potential legal disputes.

Compliance Issues

Compliance with tangible personal property tax regulations can be complex. Many states vary in their requirements, making it difficult to stay informed. For example:

- Record Keeping: You must maintain accurate records of all taxable assets, including purchase dates and values.

- Filing Deadlines: Different jurisdictions impose varying deadlines for filing returns, which may lead to penalties if missed.

- Asset Valuation: Determining the correct value of your physical assets can be confusing, especially when methods differ across regions.

It’s essential to regularly review local regulations to ensure adherence and avoid costly mistakes.

Legal Disputes

Legal disputes related to tangible personal property tax frequently arise over valuation disagreements or improper assessments. Such conflicts can take various forms:

- Assessment Appeals: If you believe your property’s assessed value is too high, you can appeal the assessment. This process often requires documentation proving the asset’s actual worth.

- Exemption Denials: Sometimes exemptions aren’t granted as anticipated. When this happens, challenging the denial through appropriate channels becomes necessary.

- Audit Outcomes: Audits may uncover discrepancies that lead to additional tax liabilities or penalties.

Navigating these legal challenges demands a solid understanding of relevant laws and proper documentation practices.

Future Of Tangible Personal Property Tax

The future of tangible personal property tax involves potential legislative changes and evolving trends in tax collection. Understanding these aspects helps you navigate the landscape more effectively.

Legislative Changes

Legislative adjustments could significantly impact how tangible personal property tax is assessed and collected. For example, states may introduce new regulations that either expand or reduce taxable items. Some possible changes include:

- Increased exemptions for small businesses to encourage growth.

- Revised assessment methods that consider fluctuating market values.

- Enhanced reporting requirements aimed at improving compliance.

Such changes can affect your business’s financial planning, so staying informed about local legislation is crucial.

Trends In Tax Collection

Tax collection practices are also shifting due to technology and policy reforms. You might notice several emerging trends, such as:

- Digital reporting tools, simplifying asset declarations.

- Data analytics used by governments to identify non-compliance issues.

- Increased audits, targeting sectors with high-value assets.

These trends signal a move toward greater accountability in taxation. Keeping track of your tangible personal property records ensures you’re prepared for any scrutiny from tax authorities.