Imagine waking up each day knowing your bank account is growing even while you sleep. Streams of income can turn that dream into reality. In today’s fast-paced world, relying solely on a single paycheck isn’t enough to secure financial freedom. Diversifying your earnings not only provides stability but also opens doors to new opportunities.

Understanding Streams Of Income

Streams of income refer to various sources through which you can earn money simultaneously. Generating multiple streams enhances your financial stability and opens pathways for wealth creation.

Definition Of Streams Of Income

Streams of income are categorized into active and passive earnings. Active income comes from direct work, like salaries or freelance gigs. Passive income arises without continuous effort, such as rental properties or dividends from investments. Each type contributes uniquely to your overall financial picture.

Importance Of Multiple Streams

Having multiple streams of income significantly reduces financial risk. If one source falters, others can sustain your lifestyle. Additionally, diversifying income sources allows you to explore different interests and skills. Here’s why it matters:

Consider how these benefits align with your financial goals and aspirations.

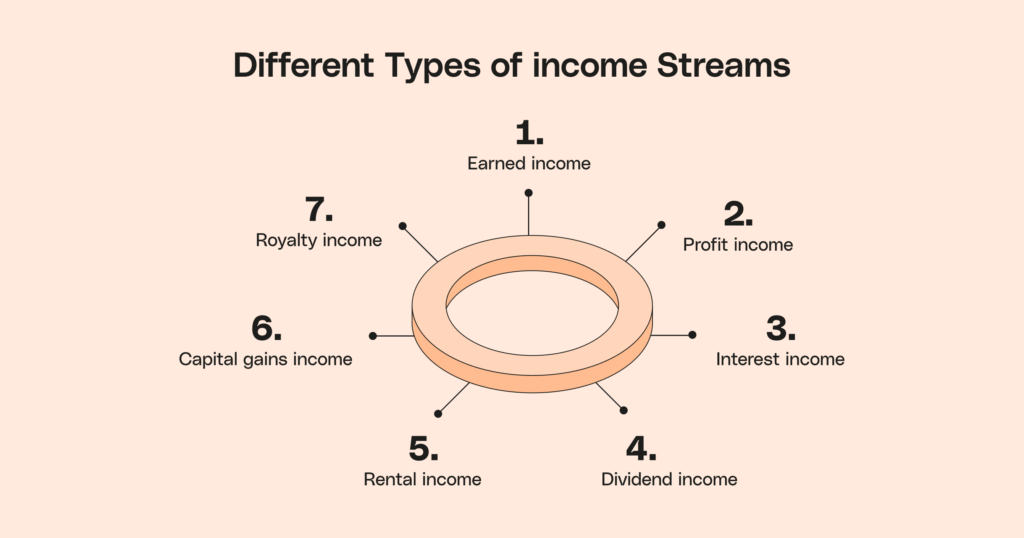

Types Of Streams Of Income

Understanding the various types of income streams can help you diversify your earnings and enhance financial stability. Here are some key categories:

Active Income

Active income involves direct work or effort in exchange for money. This type includes salaries, wages, and freelance gigs. You trade time for cash, which often means working at least a part-time job. Examples of active income include:

- Full-time job: Regular salary from an employer.

- Freelancing: Earnings from contract work like graphic design or writing.

- Consulting: Fees charged for expertise in your field.

Passive Income

Passive income generates revenue without continuous effort once established. While initial setup may require work, these sources can earn money over time with less involvement. Some examples are:

- Rental properties: Monthly payments from tenants.

- Dividends: Earnings from investments in stocks or mutual funds.

- Online courses: Sales from educational content created once.

Portfolio Income

Portfolio income comes from investments rather than direct labor. This category focuses on returns generated by assets like stocks, bonds, and real estate investment trusts (REITs). It’s crucial to manage risks effectively here. Consider these portfolio income examples:

- Stocks: Profits gained through selling shares at a higher price than purchased.

- Bonds: Interest earned on government or corporate debt securities.

- REITs: Dividends received from property holdings managed by companies.

By diversifying across these types of streams of income, you create a more resilient financial situation that can adapt to changing circumstances.

Benefits Of Diversifying Income Streams

Diversifying income streams offers numerous advantages that enhance financial resilience. You can significantly stabilize your finances while exploring different paths to growth.

Financial Security

Diversified income sources provide a safety net during uncertain times. If one stream falters, others can support your lifestyle. For example:

- Side businesses: Running an online store alongside your full-time job.

- Investments: Earning dividends from stocks while receiving rental income from properties.

- Freelance work: Offering services or products in addition to a primary salary.

These varied sources help you maintain financial stability even when circumstances change.

Risk Mitigation

Having multiple streams of income minimizes overall financial risk. When economic shifts occur, relying on a single paycheck can be precarious. Consider these points:

- Job loss protection: If you lose your primary job, freelance gigs or passive investments continue generating money.

- Market fluctuations: Different investments may react differently; some might thrive while others struggle.

- Skill development opportunities: Exploring various interests equips you with new skills that could open additional earning avenues.

By diversifying, you create a more robust financial situation capable of weathering challenges.

Strategies To Create Streams Of Income

Creating multiple streams of income enhances your financial security. Several effective strategies exist to diversify earnings, each with its unique advantages.

Investing In Real Estate

Investing in real estate provides a solid way to generate passive income. You can consider rental properties, commercial spaces, or real estate investment trusts (REITs). Look for properties in high-demand areas. For example, single-family homes often attract long-term renters. Alternatively, vacation rentals can yield higher returns during peak seasons. Conduct thorough market research before purchasing any property to ensure profitability.

Starting A Side Business

Starting a side business allows you to leverage your skills and interests for extra income. Identify what you’re passionate about or skilled at—such as graphic design, tutoring, or handmade crafts—and turn it into a revenue stream. Online platforms make it easier than ever; for instance, you could sell products on Etsy or offer services on Fiverr. Remember to balance time effectively between your main job and the side venture for sustainability.

Stock Market Investments

<strong:Stock market investments serve as another avenue for building wealth over time. You might invest in individual stocks, exchange-traded funds (ETFs), or mutual funds based on your risk tolerance and goals. Start by researching companies with strong fundamentals and growth potential. Additionally, consider setting up an automated investment plan that contributes regularly without constant oversight. This approach can help you benefit from dollar-cost averaging while minimizing emotional trading decisions.

By implementing these strategies strategically, you can build diverse income streams that contribute significantly toward achieving financial stability and independence.