Starting a business can be thrilling, but have you considered the expenses involved? Understanding start-up costs for a business examples is crucial for anyone looking to turn their entrepreneurial dreams into reality. From office space and equipment to marketing and legal fees, these initial investments can vary significantly based on your industry and goals.

Understanding Start-Up Costs

Understanding start-up costs is crucial for any business venture. These expenses vary widely based on factors like industry and specific goals.

Definition of Start-Up Costs

Start-up costs refer to the initial expenses incurred when launching a business. They encompass a range of items, including:

- Office Space: Rent or purchase costs for physical locations.

- Equipment: Necessary tools or technology for operations.

- Marketing: Initial advertising and promotional efforts to attract customers.

- Legal Fees: Costs for permits, licenses, and consultations.

These categories can significantly impact your financial planning.

Importance of Estimating Costs

Estimating start-up costs accurately helps avoid unexpected financial burdens. It allows you to allocate resources effectively. For instance:

- Knowing your office space expenses ensures you select an affordable location.

- Assessing equipment needs prevents overspending on unnecessary items.

- Planning your marketing budget helps maximize outreach without draining funds.

Ultimately, accurate cost estimation leads to better decision-making and enhances the likelihood of long-term success.

Types of Start-Up Costs

Start-up costs fall into two main categories: fixed costs and variable costs. Understanding these categories helps you plan and allocate your budget effectively.

Fixed Costs

Fixed costs remain constant regardless of business activity. These expenses are essential for maintaining operations, even if sales fluctuate. Examples include:

- Rent: Monthly payments for office space or retail locations.

- Salaries: Regular wages for full-time employees.

- Insurance: Premiums for general liability or property insurance.

You can’t avoid these costs, so budgeting accurately is crucial.

Variable Costs

Variable costs change based on your business’s level of production or sales. These expenses increase or decrease according to how much you’re operating. Some common examples are:

- Raw Materials: Supplies needed to create products.

- Utilities: Electricity and water bills that vary with usage.

- Marketing Expenses: Advertising fees that may rise during promotional campaigns.

Tracking these costs closely enables you to adjust spending as necessary while maintaining profitability.

Examples of Start-Up Costs for Different Business Types

Understanding the specific start-up costs associated with various business types can help you plan effectively. Here are examples categorized by business type.

Retail Businesses

Retail businesses often face unique expenses when starting out. Common start-up costs include:

- Inventory purchases: Stocking your store requires upfront investment in products.

- Lease or rent: Securing a retail space usually involves a deposit and initial rent payments.

- Store fixtures and displays: Shelving, counters, and signage incur significant costs.

- Point of sale (POS) systems: Implementing a system for transactions is essential.

Service-Based Businesses

Service-based businesses have different financial needs compared to retail. Typical start-up costs encompass:

- Licenses and permits: Obtaining necessary legal documents can be costly.

- Equipment and tools: Depending on the service offered, you might need specialized equipment.

- Marketing materials: Creating brochures or website content requires initial funding.

- Insurance premiums: Protecting your business often involves substantial insurance costs.

Online Businesses

Online businesses present their own set of challenges regarding start-up expenses. Main start-up costs may include:

- Website development: Building an e-commerce site typically demands investment in design and functionality.

- Domain registration and hosting fees: Securing your online presence incurs ongoing charges.

- Digital marketing campaigns: Launching ads on social media or search engines necessitates budget allocation.

- Software subscriptions: Tools for email marketing or customer relationship management require monthly fees.

By identifying these specific examples of start-up costs, you can create a more accurate budget tailored to your business type.

Factors Influencing Start-Up Costs

Start-up costs vary significantly based on multiple factors. Understanding these influences helps you estimate expenses accurately.

Location

Your business location plays a crucial role in determining start-up costs. Rent prices, utility rates, and local taxes can differ widely across regions. For instance:

- Urban areas often have higher lease rates due to demand.

- Rural locations may reduce rent but could incur additional shipping costs for inventory.

- Proximity to suppliers or customers impacts logistics expenses.

Such variations necessitate thorough research into your chosen area.

Industry Type

<strongThe type of industry directly affects the nature and magnitude of start-up costs. Different sectors require distinct resources and investments. For example:

- Retail businesses might spend on inventory, store displays, and POS systems.

- Service-based companies typically need licenses, equipment, and marketing materials.

- Tech startups often allocate funds for software development and hardware procurement.

Recognizing these industry-specific needs allows for better budgeting tailored to your operational requirements.

Managing Start-Up Costs

Managing start-up costs effectively is crucial for your business’s financial health. You can avoid unnecessary expenses by implementing smart budgeting and cost-saving strategies.

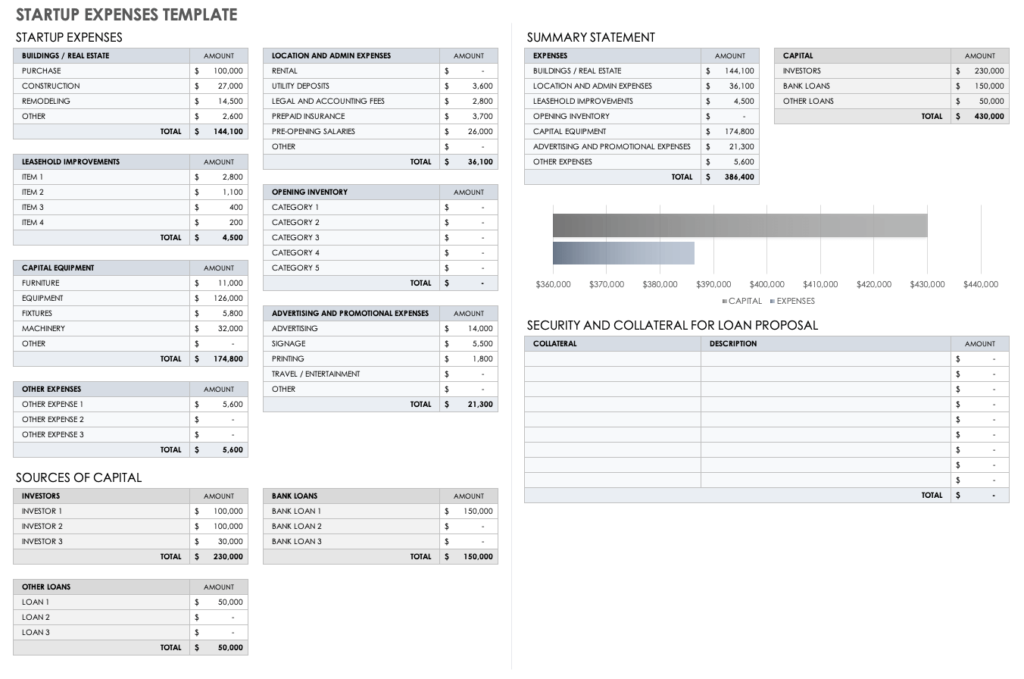

Budgeting Strategies

When it comes to budgeting, creating a detailed list of all anticipated expenses helps you stay organized. Include both fixed and variable costs in your budget plan. For example:

- Fixed Costs: Rent, salaries, insurance

- Variable Costs: Raw materials, utilities, marketing

Additionally, consider using budgeting software or templates to track your expenses in real time. Regularly reviewing your budget allows you to make adjustments when necessary. You might also want to set aside a contingency fund for unexpected costs.

Cost-Saving Tips

You can significantly reduce start-up costs through various cost-saving tips. Negotiating with suppliers often leads to better deals on materials or services. Look into bulk purchasing options as well; buying in larger quantities frequently results in discounts.

Consider these practical tips:

- Shared Workspaces: Reduce rent by utilizing coworking spaces.

- Freelancers: Hire freelancers instead of full-time employees for flexibility.

- Digital Marketing: Use social media platforms for affordable marketing efforts.

By applying these strategies and tips, you’ll manage your start-up costs more effectively while setting the foundation for long-term success.