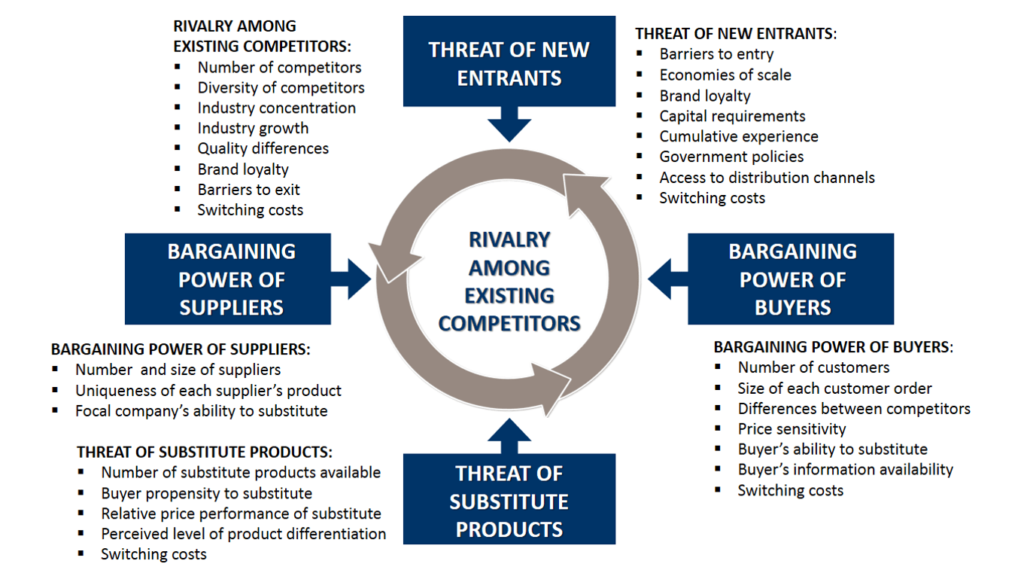

In today’s competitive business landscape, understanding the dynamics of your industry is crucial. Have you ever wondered how companies decide their strategies and gain a competitive edge? Porter’s Five Forces framework offers valuable insights into these market forces that shape competition.

Overview of Porter’s Five Forces

Porter’s Five Forces framework helps analyze industry competitiveness. Each force influences your strategic decisions and market positioning.

- Threat of New Entrants: Barriers to entry impact how easily new competitors can enter the market. For instance, industries with high startup costs or strict regulations limit new entrants.

- Bargaining Power of Suppliers: Suppliers wield power when there are few alternatives available for raw materials or components. A company dependent on a single supplier faces potential price increases.

- Bargaining Power of Buyers: When buyers have many options, they hold bargaining power that affects pricing and product quality expectations. In markets with low switching costs, this power increases significantly.

- Threat of Substitute Products or Services: The presence of alternative products can erode market share and profitability for existing companies. For example, electric vehicles threaten traditional gasoline-powered cars.

- Industry Rivalry: Intense competition among existing firms drives down prices and profits. High levels of rivalry often stem from numerous competitors offering similar products or services.

Understanding these forces equips you to navigate challenges in your industry effectively while identifying potential opportunities for growth and innovation.

The Five Forces Explained

Understanding the five forces in Porter’s framework helps you analyze industry dynamics effectively. Each force influences strategic decision-making and overall market health.

Threat of New Entrants

High barriers to entry often deter potential competitors. For instance, industries like telecommunications require significant capital investment and regulatory approvals, making it tough for new players to enter. Conversely, sectors with low startup costs, such as e-commerce platforms, see frequent entries from startups. This dynamic shapes competitive landscapes significantly.

Bargaining Power of Suppliers

When few suppliers exist for critical materials, their bargaining power increases. Take the semiconductor industry; major suppliers can dictate terms due to limited options for manufacturers. In contrast, if multiple alternative suppliers are available—like in retail—you’ll find that businesses enjoy more favorable pricing and terms. This balance affects profit margins directly.

Bargaining Power of Buyers

The more choices buyers have, the stronger their bargaining position becomes. In consumer electronics, brands compete fiercely on price and features because buyers can switch easily between products. On the other hand, in niche markets where options are scarce—think luxury goods—companies maintain higher pricing power. This shift impacts sales strategies.

Threat of Substitute Products

The presence of substitutes can significantly undermine a company’s market share. Consider how streaming services like Netflix replaced traditional cable TV subscriptions. As alternatives increase within an industry—like plant-based meat versus beef—the competition intensifies. Companies must innovate continually to retain customer loyalty amidst rising substitutes.

Rivalry Among Existing Competitors

Intense rivalry drives down prices and profits across industries. For example, airlines frequently engage in fare wars to attract passengers while maintaining tight profit margins. However, in markets with fewer players—such as pharmaceuticals—the competition may focus instead on innovation rather than price reduction. Understanding this dynamic helps tailor your business strategy effectively.

Applications of Porter’s Five Forces

Porter’s Five Forces framework applies to various business contexts, enabling companies to assess their competitive environment effectively. This analysis fosters strategic insights and informs decision-making.

Industry Analysis

Industry Analysis involves evaluating the competitive landscape using Porter’s Five Forces. For example, in the automobile industry, high barriers to entry like capital investment and regulatory requirements deter new entrants. Similarly, established players control supply chains, impacting suppliers’ bargaining power significantly. In contrast, industries like technology often experience lower barriers due to rapid innovation and evolving consumer preferences, leading to a higher threat of substitutes.

Strategic Planning

Incorporating Porter’s Five Forces into your Strategic Planning helps shape effective business strategies. For instance:

- When launching a new product in the consumer electronics sector, assessing the bargaining power of buyers can guide pricing strategies.

- Analyzing competitor dynamics within the retail market allows you to identify opportunities for differentiation and innovation.

- Understanding supplier dynamics in sectors like pharmaceuticals provides insights into cost structures and potential disruptions.

By leveraging this framework during planning stages, you gain clarity on market positioning and areas for growth.

Limitations of Porter’s Five Forces

Porter’s Five Forces framework provides valuable insights, but it has limitations that can impact its effectiveness.

One limitation is its static nature. The framework analyzes competition at a specific point in time. It doesn’t account for rapid market changes or technological advancements. For instance, consider how the rise of electric vehicles disrupted traditional automotive companies.

An additional limitation involves subjective interpretation. Different analysts may prioritize forces differently based on personal experiences or biases. This subjectivity can lead to inconsistent conclusions across industries.

The model often overlooks external factors. Economic conditions, regulatory changes, and sociocultural shifts significantly influence industry dynamics. For example, the COVID-19 pandemic showcased how unforeseen events can alter competitive landscapes overnight.

The focus primarily stays on the present. While assessing current conditions is crucial, neglecting future trends can hinder long-term planning. Companies in fast-evolving sectors must adapt quicker than what the model suggests.

You might encounter challenges with oversimplification as well. Complex industries often cannot be fully understood through just five forces alone. In technology sectors, multiple factors interact dynamically beyond those outlined by Porter’s framework.

Overall, while Porter’s Five Forces offers a solid starting point for analysis, recognizing its limitations ensures a more comprehensive understanding of industry competitiveness.