Imagine a world where illicit profits are transformed into seemingly legitimate wealth. Money laundering is the process that makes this possible. It’s not just a financial crime; it’s a complex web of transactions designed to hide the origins of illegally obtained money. Understanding its meaning is crucial for anyone interested in finance, law, or simply staying informed about global issues.

In this article, you’ll explore the various stages of money laundering and how they impact economies worldwide. From layering funds through intricate transactions to integrating them back into the economy, each step reveals the lengths criminals go to obscure their tracks. Have you ever wondered how authorities track these activities? By delving into real-world examples, you’ll gain insights into both the methods used by offenders and the measures taken by governments to combat this pervasive issue.

Money Laundering Meaning

Money laundering refers to the process of making illegally obtained money appear legitimate. This activity involves a sequence of transactions designed to obscure the original source of funds, allowing criminals to use their profits without attracting attention.

Definition of Money Laundering

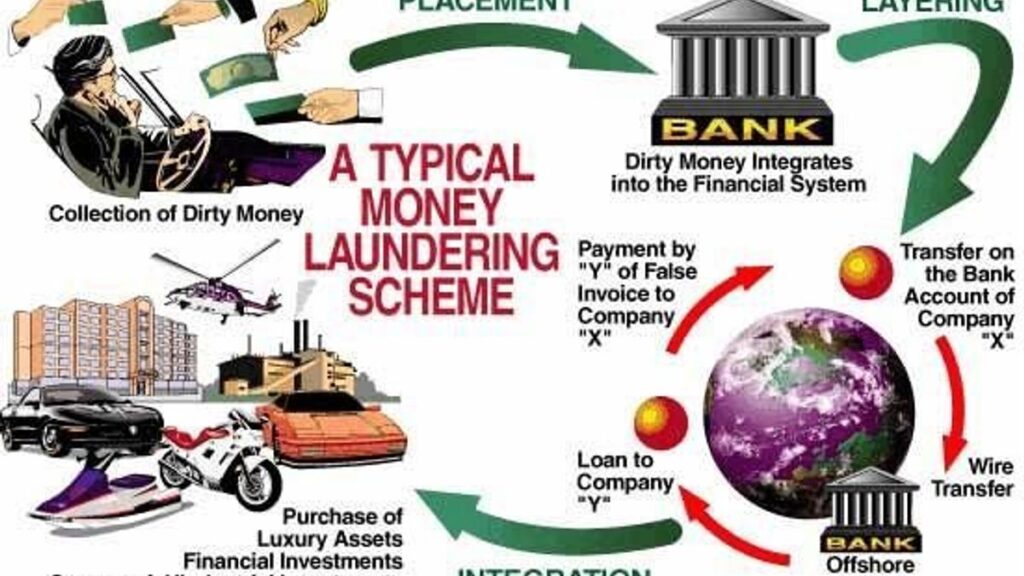

Money laundering is a financial crime that disguises illegal proceeds as legitimate income. Criminals typically execute three main stages: placement, layering, and integration. During placement, illicit money enters the financial system. In layering, transactions obscure any traces of origin. Finally, in integration, laundered money re-enters the economy as seemingly legal assets.

Historical Context

The concept of money laundering has evolved significantly over time. Its origins trace back centuries when organized crime groups sought ways to conceal profits from illegal activities. For instance:

- In the 1920s and 1930s, American mobsters used casinos and bars for this purpose.

- The Bank Secrecy Act of 1970 marked a pivotal moment by requiring banks to report suspicious activities.

- In recent years, global efforts intensified with international agreements aimed at combating financial crimes.

Understanding this context highlights how authorities continuously adapt strategies against evolving laundering techniques.

Methods of Money Laundering

Money laundering employs various methods to conceal illicit funds. Understanding these methods allows you to recognize the complexities involved in transforming illegal money into legitimate assets.

Layering Techniques

Layering involves creating a complex web of transactions to obscure the source of funds. Criminals often use several techniques, including:

- Bank Transfers: Moving money through multiple accounts, often across different banks and countries.

- Shell Companies: Establishing companies that exist only on paper to disguise ownership and generate fake financial activity.

- Cryptocurrency Exchanges: Converting cash into cryptocurrencies and then back into fiat currency through multiple exchanges.

These actions create confusion about the original source of the funds, complicating efforts to trace them.

Integration Strategies

Integration is where laundered money re-enters the economy as seemingly legitimate income. Common strategies include:

- Real Estate Investment: Purchasing properties with illicit funds, then selling them for profit or renting them out.

- Luxury Goods Purchases: Buying high-value items like cars or jewelry, which can later be sold for clean cash.

- Gambling Operations: Using laundered money at casinos; winnings appear as legal earnings.

By employing these strategies, criminals effectively blend their illegal proceeds into everyday economic activities.

Legal Implications

Understanding the legal implications of money laundering is crucial for anyone involved in finance or law. Money laundering not only facilitates criminal activity but also undermines financial systems. Regulations and penalties are significant aspects of combating this issue.

Money Laundering Regulations

Money laundering regulations aim to prevent illicit financial activities. Various laws exist worldwide, including:

- Bank Secrecy Act (BSA): Requires banks to report transactions over $10,000.

- USA PATRIOT Act: Enhances measures against money laundering after 9/11.

- Financial Action Task Force (FATF): Sets international standards for anti-money laundering (AML) practices.

These regulations promote transparency and accountability in financial transactions, making it harder for criminals to launder money.

Penalties for Money Laundering

Penalties for engaging in money laundering can be severe. They often include:

- Fines: These can exceed millions of dollars depending on the severity.

- Prison Sentences: Offenders may face up to 20 years or more behind bars.

- Asset Forfeiture: Authorities can seize assets tied to illicit funds.

Such consequences serve as a deterrent, emphasizing that money laundering carries significant risks both legally and financially.

Impacts of Money Laundering

Money laundering significantly affects economies and societies around the globe. Understanding these impacts is essential for recognizing the broader implications of illicit financial activities.

Economic Consequences

Economic instability arises from money laundering activities. These actions undermine legitimate businesses, distort market competition, and erode consumer trust. For instance, when criminal organizations infiltrate various sectors, they can manipulate pricing and availability, leading to unfair advantages. Additionally:

- Tax revenue loss: Governments may face a decline in tax revenues due to unreported income.

- Investment deterrence: Foreign investors often avoid regions with high levels of corruption linked to money laundering.

- Increased regulatory costs: Financial institutions incur additional expenses related to compliance measures.

You’ll notice that these consequences create a vicious cycle that hampers sustainable economic growth.

Social Ramifications

Social structures experience significant strain due to money laundering. It fosters an environment where crime thrives and communities suffer. This leads to several social issues:

- Heightened crime rates: As organized crime groups gain power through laundered funds, violent crimes may increase.

- Corruption escalation: Law enforcement agencies may become compromised as corrupt practices take root.

- Reduced public services: With diminished tax revenues, governments struggle to fund essential services like healthcare and education.

These ramifications can create a disconnect between citizens and governing bodies while perpetuating cycles of poverty and inequality.