Have you ever wondered how illicit funds are transformed into seemingly legitimate money? Money laundering examples reveal the intricate methods criminals use to disguise their financial activities. From complex schemes involving shell companies to simple cash transactions at casinos, these tactics can be surprisingly varied and creative.

Overview Of Money Laundering

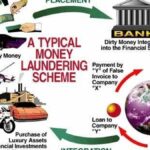

Money laundering involves several stages designed to conceal the origins of illicit funds. Understanding these stages provides clarity on how criminals utilize various methods. Here are some common examples:

- Placement: This initial stage includes depositing illegally obtained cash into financial institutions. For instance, a criminal might use small amounts to avoid detection.

- Layering: In this phase, individuals engage in complex transactions to obscure the source of money. They may transfer funds between multiple accounts or invest them in different assets.

- Integration: The final step allows criminals to reintroduce laundered money into the economy as legitimate earnings. Examples include purchasing high-value items like real estate or luxury cars.

Cash-intensive businesses often serve as fronts for laundering activities. Restaurants and casinos frequently mix legitimate earnings with illegal profits, making it difficult to trace the original source of funds.

Additionally, shell companies play a significant role in facilitating money laundering schemes. These companies exist only on paper and do not conduct any actual business operations, allowing for easy manipulation of finances without scrutiny.

Another method is through trade-based money laundering, where over- or under-invoicing occurs during international trade transactions. Criminals can hide large sums by inflating costs or misrepresenting goods shipped across borders.

Overall, recognizing these examples helps in understanding the complexities and tactics involved in money laundering schemes more clearly.

Historical Examples Of Money Laundering

Money laundering has a long history, marked by various significant examples that illustrate its complex nature. Understanding these instances helps shed light on how illicit funds are obscured and integrated into the legitimate economy.

The Drug Trade and Money Laundering

The drug trade serves as a major source of money laundering activities. Criminal organizations often use sophisticated methods to clean their profits. For instance:

- Colombian Cartels: In the 1980s, cartels like Medellín used multiple strategies such as smuggling cash across borders and investing in front businesses to disguise their earnings.

- Mexican Drug Traffickers: They frequently engage in layering techniques, moving money through different countries via shell companies or casinos, making it hard for authorities to trace original sources.

These methods highlight how the drug trade exploits financial systems to launder billions annually.

The Real Estate Market and Money Laundering

Real estate markets also provide fertile ground for money laundering schemes. Properties serve as valuable assets that can easily absorb large amounts of illicit cash. Consider these examples:

- High-End Purchases: Criminals often buy luxury properties with cash or through anonymous entities, allowing them to mask the true ownership.

- Overvalued Transactions: Some individuals manipulate property prices by inflating values during sales or using false appraisals, which creates artificial legitimacy around illicit funds.

Such tactics show how real estate transactions can obscure the origins of wealth while contributing to inflated market conditions.

Notable Recent Case Studies

Money laundering schemes gain attention when they involve large institutions. Here are two significant cases that illustrate the complexities of this crime.

The HSBC Scandal

The HSBC scandal emerged in 2012, revealing that the bank facilitated money laundering for drug cartels. U.S. authorities found that HSBC allowed over $880 million from Mexican drug trafficking organizations to flow through its accounts. During investigations, it became clear that compliance failures enabled these transactions, highlighting weaknesses in their anti-money laundering (AML) practices. As a result, HSBC faced a hefty fine of $1.9 billion and underwent substantial reform efforts.

The Danske Bank Case

In another striking example, the Danske Bank case involved €200 billion flowing through its Estonian branch between 2007 and 2015. Investigators uncovered a staggering amount of suspicious transactions linked to Russian oligarchs and other entities. This raised serious concerns about the bank’s internal controls and risk management systems. Consequently, Danske Bank faced intense scrutiny from regulators across Europe and significant reputational damage due to its failure to prevent such extensive money laundering activities.

These case studies underscore how even major financial institutions can become embroiled in complex money laundering schemes, often leading to severe consequences both legally and financially.

Different Techniques Used in Money Laundering

Money laundering employs various techniques to disguise illicit funds. Understanding these methods highlights the complexity of this crime and the challenges in combating it.

Structuring (Smurfing)

Structuring, often known as smurfing, involves breaking down large sums of money into smaller deposits. For example, a criminal may deposit $9,000 across multiple bank accounts to evade detection thresholds. This tactic helps avoid triggering reporting requirements that banks must follow for larger amounts. Additionally, criminals might use numerous individuals or “smurfs” to execute these transactions, further complicating tracking efforts.

Trade-Based Money Laundering

Trade-based money laundering manipulates international trade transactions to disguise illegal funds. Criminals may inflate invoice values or falsify shipping documents to transfer money under the guise of legitimate business operations. For instance:

These schemes exploit the complexities of global commerce and create substantial difficulties for law enforcement agencies monitoring financial flows.